crypto tax calculator australia

Koinly is developed in close collaboration with tax firms around the world to ensure we comply with all the applicable tax laws as they relate to cryptocurrency. It serves as a one-stop shop to handle cryptocurrency tax reporting for all types of cryptocurrency use cases whether you are mining staking lending or simply buying or trading CryptoTraderTax will automate your tax reporting.

7 Best Crypto Tax Software Solutions 2022 Reviews Fortunly

Last updated on 6 March 2022.

. The closest guidance that could be used to infer how staking income should be taxed is the tax guidance on mining income issued on. Just in time for tax season in the United States Australian startup CryptoTaxCalculator CTC announced it has raised seed capital to expand its automated crypto tax reporting tool further into. Therefore our crypto tax application does not store or keep your crypto data.

Koinly can help you generate your crypto tax reports - no matter where you live. This up to date tax calculator applies to the last financial year ending on 30 June. Signing up and testing out the platform is completely free.

IRS has not issued any staking specific crypto tax guidance. Estimate how big your refund will be with our easy-to-use free income tax calculator. Upload to our crypto.

CryptoTraderTax is the easiest and most intuitive crypto tax calculating software. From the US to Scandinavia to Japan and every country in between. The Best Crypto Exchanges for Australia.

You simply review your crypto transactions that you wish to export from your current exchange eg BTC Markets and export this data as a CSV file which is then saved to your device. Reliable accurate cryptocurrency tax reports. At Crypto Tax Calculator Australia we support and strongly believe in customer privacy.

Every Bitcoin exchange offers. Be mindful it is only an estimate but does calculate the same way as the ATO works out your refund. Continuing with the example above in addition to the 20000 gain coming from crypto Jennet also earned 50000 from her full-time.

This should be for your current tax return that is due. In this guide we have reviewed the best crypto exchanges in AustraliaIf youre looking at buying Bitcoin or other cryptocurrencies youll need to register on a cryptocurrency exchange where you can buy Bitcoin store it or start trading it for other digital assets.

Crypto Tax In Australia The Definitive 2021 2022 Guide

The Ultimate Australia Crypto Tax Guide 2022 Koinly

Koinly Crypto Tax Calculator For Australia Nz

Crypto Tax In Australia The Definitive 2021 2022 Guide

Crypto Tax In Australia The Definitive 2021 2022 Guide

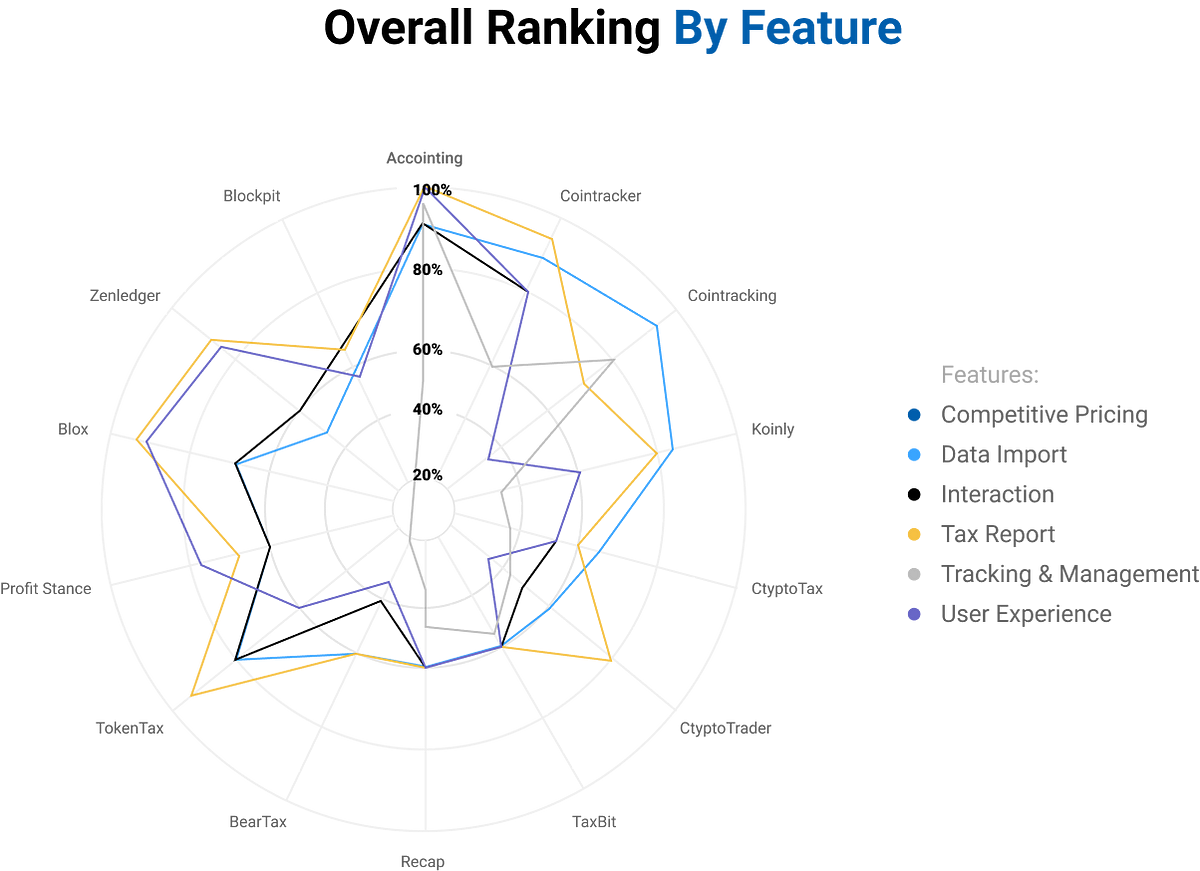

Best Crypto Tax Software Top 5 Bitcoin Tax Calculator 2022 Coinmonks

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Australia Tax Rates For Crypto Bitcoin 2022 Koinly

Crypto Tax In Australia The Definitive 2021 2022 Guide

![]()

Cointracking Crypto Tax Calculator

How To Calculate Crypto Tax In Australia Youtube

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Cryptocurrency Taxes In Australia 2021 2022 Guide Cointracker

Crypto Tax Australia Guide 2022 Cryptocurrency Tax Swyftx

Crypto Tax In Australia The Definitive 2021 2022 Guide

Crypto Tax Australia Guide 2022 Cryptocurrency Tax Swyftx